Bangalore real estate 2025 Update

Bangalore real estate 2025 Update shows that the Real estate market in Bangalore is growing at a fast rate due to IT industry growth and the new infrastructure. Many people are moving to the city in search of jobs, and East Bangalore and North Bangalore are seeing a rise in apartments.

Ongoing Projects like Metro Phase 2, Peripheral Ring Road, and KIA Elevated Expressway are increasing property prices. The recent real estate trends of 2025 show more people are looking for smart homes, and well-planned luxury townships.

If you are planning to invest in Bangalore in 2025, taking a look at the recent price trends is an essential factor. Comparing the current year trends with last year's trends will help buyers to know in which area to invest to get maximum returns.

Here is the short table that shows the recent price trends in different areas of Bangalore

| Area | Price in 2025 (per sq ft) | Price in 2024 (per sq ft) | YoY Growth |

|---|---|---|---|

| Whitefield | Rs. 8,500 to Rs. 10,500 | Rs. 7,600 to Rs. 9,200 | 6.6% |

| Hebbal | Rs. 7,500 to Rs. 9,800 | Rs. 6,200 to Rs. 8,200 | 8.5% |

| Bannerghatta Road | Rs. 6,500 to Rs. 8,700 | Rs. 5,600 to Rs. 7,200 | 8.4% |

| Malleswaram | Rs. 9,500 to Rs. 11,800 | Rs. 8,600 to Rs. 10,700 | 5.8% |

| Rajajinagar | Rs. 8,500 to Rs. 10,500 | Rs. 7,800 to Rs. 9,900 | 6.7% |

| Jayanagar | Rs. 10,500 to Rs. 12,800 | Rs. 9,800 to Rs. 11,800 | 6.7% |

| Koramangala | Rs. 10,900 to Rs. 13,500 | Rs. 10,500 to Rs. 12,500 | 5.1% |

| Electronic City | Rs. 5,900 to Rs. 7,500 | Rs. 4,800 to Rs. 5,900 | 9.9% |

| Hennur Road | Rs. 5,800 to Rs. 7,800 | Rs. 5,500 to Rs. 6,700 | 10.1% |

| Yelahanka | Rs. 4,800 to Rs. 6,800 | Rs. 4,600 to Rs. 5,800 | 9.2% |

| Banaswadi | Rs. 5,900 to Rs. 7,500 | Rs. 5,500 to Rs. 6,800 | 7.1% |

| Kanakapura Road | Rs. 5,500 to Rs. 6,800 | Rs. 4,700 to Rs. 5,900 | 8.7% |

| Indiranagar | Rs. 13,500 to Rs. 16,500 | Rs. 12,500 to Rs. 14,800 | 6.6% |

| Sarjapur Road | Rs. 6,500 to Rs. 8,800 | Rs. 5,800 to Rs. 7,800 | 8.3% |

| Varthur Road | Rs. 5,800 to Rs. 7,800 | Rs. 5,800 to Rs. 6,800 | 7.6% |

- Whitefield - Whitefield remains the sought-after area due to its proximity to IT parks and job offers.

- Sarjapur Road - High demand due to nearness to tech hubs and affordable real estate options.

- Electronic City - The demand is driven by the presence of major IT hubs and new housing projects.

- Koramangala - A premium location that is popular among IT workers.

- Hebbal - The area continues to see a rise in demand with the Hebbal elevated corridor.

The demand for housing in Bangalore is still strong in 2025. This is fueled by the city's IT and startup ecosystem, which draws skilled people from India. These factors are increasing the appeal of the real estate market in the city in 2025,

- IT Driven Demand: As there are a number of job offers in the IT sector, many people move towards the city, and it creates a real estate demand. Areas near IT hubs see a huge demand with an increase in property prices.

- NRI Appeal: Bangalore is a preferred choice for NRIs who are looking to invest back in their home. The city’s lifestyle and pleasant climate make it an attractive area to settle.

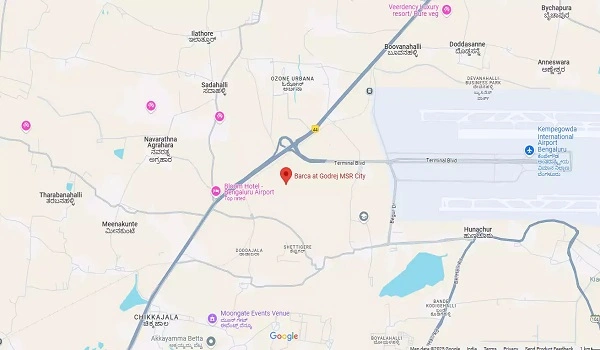

- Supply Landscape: Big builders are launching new residential projects, and demand is keeping pace with which shows a healthy market momentum. One of the best ultra-luxury apartments to invest in 2025 is Godrej MSR City, which is in Shettigere from Godrej Properties. The project offers 4000 high-end apartments with modern amenities and potential for high ROI.

Bangalore's commercial real estate market is durable in 2025, as it is driven by the growing IT and small startup hubs.

The YoY Growth of the commercial real estate market is as follows,

| Area | YoY Growth (%) |

|---|---|

| MG Road | 5% |

| Indiranagar | 6.67% |

| Hebbal | 8.57% |

| Sarjapur Road | 8.33% |

| Bellandur | 10% |

| Whitefield | 8.33% |

| Koramangala | 5% |

| Electronic City | 9.52% |

| Banaswadi | 7.14% |

| Rajajinagar | 6.67% |

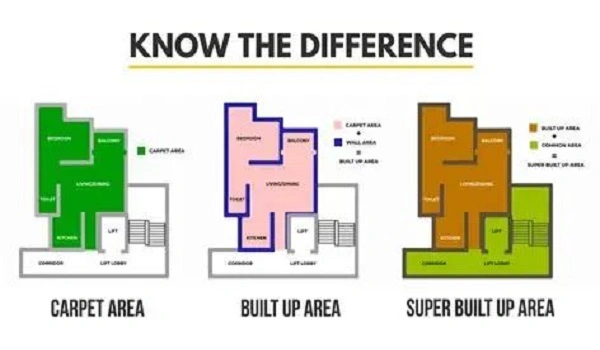

Bangalore real estate data varies widely based on size, location, and the builder's reputation. The price varies with different property types, which are as follows,

- Apartments:

- Budget friendly Options (In emerging areas): Rs. 5,500 - 7,500 per sq. ft.

- Mid Range Housing (In developing areas): Rs. 7,500 - 10,800 per sq. ft.

- Premium Homes (In prime locations): Rs. 11,500 - 23,000 per sq. ft.

- Villas: The villa price ranges from Rs. 2.5 Crores to Rs. 10 Crore, depending on the built up area and its location.

- Plots: Land prices range from Rs. 6,000 to Rs. 18,500 per sq. ft., depending on the area.

Investing in any properties in Bangalore will give a high ROI in the future.

Bangalore real estate market graph shows that 2025 is the best time to invest as there will be a steady growth in the upcoming years up to 2030. Despite the high-end prices, the real estate properties promise investors high ROIs.

- What is the current real estate trend of Bangalore city in 2025?

Property prices are increasing at a very rapid rate, and demand is also increasing in the city. - Are Bangalore property prices falling in 2025?

Recently, the Bangalore real estate market has shown some signs of stabilisation, as there is an oversupply of properties. - Is 2025 a good time to consider to invest in Bangalore?

Yes, 2025 is the best year to invest as property prices will increase in the coming years, and buyers can get good value for money. - What types of real estate properties are currently in demand in 2025 in Bangalore?

Luxury apartments, smart homes, and gate community townships are very popular.