Role Of Credit Score In Home Loan Approvals 2025

In 2025, your credit score isn't just a number—it's one of the most important things banks look at when you apply for a home loan. It decides not only whether your loan gets approved, but also how much you'll pay back, what interest rate you get, and even how fast your loan gets processed.

For anyone planning to buy a home—especially in growing areas like Shettigere near the Bangalore airport—knowing your credit score can make a big difference. If you're looking at premium projects like Godrej MSR City, having a good score can help you secure better terms and move in faster.

A credit score is a three-digit number between 300 and 900 that shows how well you've handled money in the past. In India, credit bureaus like CIBIL, Equifax, and Experian calculate your score based on how you've paid off loans, used credit cards, and managed other debts.

- 750 and above: Excellent. Banks love it.

- 700–749: Good. Usually approved with some checks.

- 650–699: Okay. You may still get the loan, but with higher interest.

- Below 650: Risky. You may be rejected or offered less money at a high rate.

In 2025, credit scores have become even more important because of new rules from the Reserve Bank of India (RBI). Banks are now stricter and rely more on digital tools to check your credit profile instantly.

Your credit score is often the first thing banks check. If your score is low, your loan might get rejected right away—no matter your income or job. If your score is high, the process is smoother and faster.

With more automation in banking, lenders get instant access to your credit records through Aadhaar and PAN. This means there's less room for manual review or explanations if your score is weak.

Your score also decides how much interest you'll pay on your home loan.

Here's a quick example (for a ₹50 lakh loan over 20 years):

| Credit Score | Likely Interest Rate | Monthly EMI |

| 750+ | Around 8.1% | ₹42,000 |

| 650–749 | Around 9.5% | ₹46,600 |

| Below 650 | 10.5% or more | ₹50,000 |

A higher score can save you ₹2–3 lakh over the life of your loan. That's enough to furnish your home at Godrej MSR City or cover registration costs.

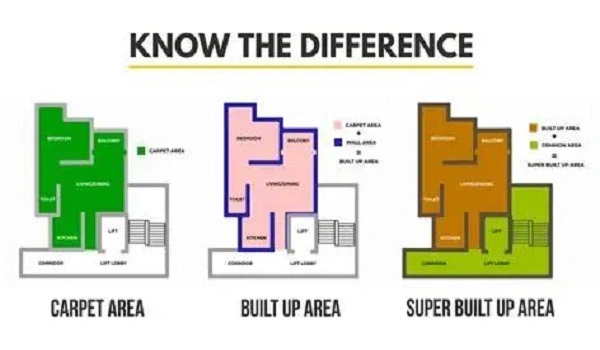

With a high score, banks are more likely to give you a bigger loan. They may also allow a higher loan-to-value ratio (LTV), which means you need to pay less upfront.

For lower scores, banks may reduce the loan amount or ask for a bigger down payment.

If your score is strong, you can choose a longer loan tenure—up to 30 years in some cases—which lowers your monthly EMI. You may also get more freedom to prepay or reduce your EMI without extra charges.

Good credit means faster loan approvals. Some banks even give pre-approved loan offers if you have a high score. This can help you grab early deals in new launches, like limited-period offers in Godrej MSR City.

Here are some important updates that make credit scores even more useful:

- Updated Every 15 Days: Your score now refreshes twice a month, not once.

- Tracks 36 Months of History: Banks now look at 3 years of repayment habits.

- First-Time Borrower Friendly: Even if you've had credit for less than 6 months, you can still get a score.

- Rejection Reasons Must Be Shared: If a bank rejects your loan due to your credit score, they must explain why.

- One Missed EMI Won't Hurt Immediately: Banks now have to give 30 days' notice before reporting a late payment.

Understanding the basics can help you improve your score before applying.

Paying credit card bills and loan EMIs on time is the most important part. One missed payment can lower your score by 50 points or more.

Don't use too much of your credit card limit. Try to keep it below 30%. For example, if your card limit is ₹1 lakh, don't spend more than ₹30,000.

Older accounts help. Don't close old credit cards unless necessary.

Having a mix of secured loans (like home or car loans) and unsecured loans (like personal loans or credit cards) shows that you can manage different types of debt.

Too many applications in a short time can hurt your score. Apply only when you really need a loan.

If your score isn't where it should be, here are some simple steps to fix it:

- Pay your EMIs and credit card bills on time

- Keep your credit card balances low

- Don't apply for multiple loans at once

- Check your credit report once a year (it's free!)

- Dispute any errors you find quickly

- Keep old credit cards active if they're in good standing

- Add a co-applicant with a better score if needed

Shettigere is growing fast, thanks to its location near the airport and upcoming Metro connectivity. Projects like Godrej MSR City are becoming popular among professionals and families who want a calm, well-connected place to live.

Banks trust homes in these projects because the paperwork is clean, and the builder is reliable. If your credit score is also strong, it becomes easier to get approved—and you might even get better rates or loan terms.

In 2025, having a good credit score is one of the best things you can do if you plan to take a home loan. It affects your approval, interest rate, loan amount, and how easy the process will be.

Before applying, take a little time to review your credit, fix any issues, and plan ahead. Whether you're looking at a modern apartment in the city or a township like Godrej MSR City in North Bangalore, a strong credit score can help make your home ownership journey smoother—and more affordable.