Investment in North Bangalore real estate 2025

Investment in North Bangalore real estate 2025 delivers robust returns, with prime prices up 8.3% year-on-year (Apr 2024–Mar 2025) and micro-markets like Kogilu surging 29.2% as of May 2025. Average rates stand at ₹9,159 per sq ft—compared with South Bangalore’s ₹7,070 and Whitefield’s ₹9,485—and rental yields have climbed from 3.38% in FY2019 Q3 to 4.48% in FY2023 Q3. Lower entry prices, strong lease demand and fast appreciation make North Bangalore one of India’s top investment destinations.

North Bangalore’s growth is fueled by massive infrastructure roll-outs. By end-2025, 18.8 km of the Yellow Line and 13.9 km of the Pink Line will be operational; the 280.8 km Satellite Town Ring Road and 116 km Peripheral Ring Road aim to finish by December 2025. The 148 km Bengaluru Suburban Rail Project and expansions at Kempegowda International Airport (Terminal 2, second runway) will further cut commute times by up to 40%.

Strong demand is reflected in inventory and jobs. Unsold stock has fallen by 4%, trimming the overhang to nine months, while over 4,500 ready units are listed online. Some 80 under-construction projects across 3,000+ acres will add 50,000+ homes by 2030. Major employment hubs—2,500 acre Aerospace & Defence Park, 3,000 acre Aero SEZ, 40 sq km ITIR zone and 1 million sq ft Ebisu Tech Park—are set to create 100,000+ jobs by 2026, ensuring steady demand and capital appreciation.

North Bangalore’s residential stock shows a healthy nine-month absorption as of December 2024, signaling fast uptake of new supply. Overall Bangalore’s prime market grew at a 44% five-year CAGR in micro-markets like Bidarahalli; Devanahalli saw 15–20% appreciation over three years. In 2025, premium segments are forecast to rise 8–10% annually, with rental yields projected to grow 20–25% by 2026.

- Metro Corridors: 18.82 km Yellow Line operational Jan 2025; 13.92 km Pink Line by Sep 2026; 58.19 km Airport Blue Line by early 2027.

- Expressways: 280.8 km STRR (80 km active) by Dec 2025; PRR sections finish end-2025.

- Suburban Rail: 148 km network, Corridors 1 & 4 expected by 2026 (progressing in 2025).

- Jobs: Aerospace & Defence Park (2,500 acres) and Aero SEZ (3,000 acres) add thousands of roles; ITIR (40 sq km) and Ebisu Tech Park (1 M sq ft) boost tech employment.

- Devanahalli: ₹3,500–₹6,000/sq ft; 15% growth in 2024; forecast 8–12% annually.

- Yelahanka: ~₹6,000/sq ft; rental yields ~4.5%; strong NRI and professional demand.

- Hebbal: ₹4,000–₹7,407/sq ft (avg ₹6,024); near Airport Metro interchange; tunnel road due 2025.

- Thanisandra: 25–28% projected five-year growth; key access to Manyata Tech Park and ORR.

Q1 2025 average rate in North Bangalore was ₹8,165/sq ft. Devanahalli 2 BHKs rent ₹15,000–₹25,000 pm, supporting yields of ~4.5%. Whitefield grew 10% YoY with 3.5–4.2% yields; South Bangalore’s mature market saw slower gains. North Bangalore’s 12–15% annual appreciation outpaces these zones.

- Construction Delays: Verify RERA registration (e.g., PRM/KA codes) to ensure builder accountability.

- Regulatory Changes: Under-construction homes attract 5% GST; RERA mandates escrow and delivery timelines.

- Due Diligence: Choose developers with ≥ 80% on-time delivery, such as Godrej Properties and Brigade Group.

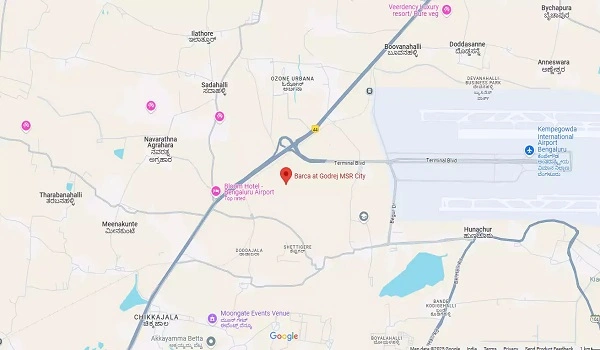

- Godrej MSR City (Godrej Properties): Expected ROI of 10–15% p.a. with 4–6% rental yield; 62-acre smart township near KIA.

- Aditya Birla Trimaya (Birla Estates): ~9.9% CAGR and 60.5% ROI; 52-acre integrated community near airport road.

- Brigade El Dorado (Brigade Group): 17.1% CAGR and 120.2% ROI; 50-acre aerospace-park township.

- Ebony at Brigade Orchards (Brigade Group): Strong long-term value; premium enclave within a 135-acre smart township.

- Godrej Ananda (Godrej Properties): High ROI in Bagalur region; eco-centric homes near Aerospace Park.

North Bangalore values are projected to rise 20–30% by 2030 (8–10% p.a.). Key catalysts include KIA’s $2 billion expansion (100 M pax capacity), new mixed-use townships, and continued IT park growth.

North Bangalore’s infrastructure, jobs and competitive pricing make it a top investment market. Next steps: shortlist RERA-registered projects, schedule site visits, compare payment plans, and secure financing to lock in early-bird rates.

ROI of 10–15% p.a. with yields up to 4.5%.

Devanahalli and Yelahanka deliver 4 - 4.5% yields.

Yellow Line (Jan 2025) and STRR (Dec 2025) should lift prices by 5–8% within a year.

Yes—North’s 8.3% YoY growth outpaces South’s average and offers lower entry costs.

Verify RERA details, check on-time delivery record, review project approvals and escrow compliance.

Godrej Properties Newlaunch Project is Godrej MSR City

| Enquiry |