Why Construction-Linked Payment Plans Are Gaining Popularity

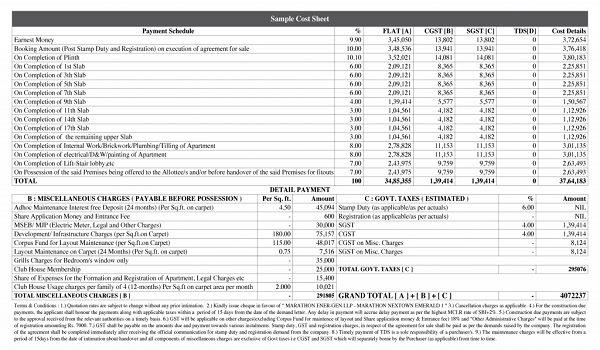

A Construction-Linked Payment Plan (CLP) is a payment method where you pay for a home in stages, based on how much construction is completed. Instead of paying most of the money upfront, you release small amounts as the building progresses—like when the foundation is done, a floor is built, or the walls are completed.

This method is now preferred by many homebuyers in cities like Bangalore, especially in fast-growing areas such as Shettigere. Projects like Godrej MSR City follow this approach, offering more safety and flexibility for buyers.

In the past, many people followed traditional down payment methods, where a large amount had to be paid early. But times have changed. Today, both buyers and builders want more flexibility, safety, and trust.

- Buyers are more cautious and better informed.

- RERA (Real Estate Regulatory Authority) ensures that developers follow rules and link payments to actual construction.

- Builders also prefer steady cash flow during construction instead of getting all money upfront.

- 1. You Pay Only for Work That's Done – With a CLP, your payments follow real progress. If a project slows down, your money is not locked in. You only pay when work is complete at each stage. This keeps your risk low.

- 2. No Heavy Upfront Payment – Instead of paying 80–90% within a few months, you pay in smaller parts over the construction period—usually 2 to 3 years. This makes it easier to manage your finances, especially if you have a regular income.

- 3. Lower Pre-EMIs (Interest Payments Before Possession) – If you take a home loan, the bank will release the loan in parts as per the builder's progress. You pay interest (Pre-EMI) only on the amount released, not the full loan. Full EMIs usually start only after you get possession.

- 4. Entry at Lower Prices – Homes under construction are often priced lower than ready-to-move-in homes. So, you lock the price early and may gain from property value increases by the time it's ready.

- They get steady payments during construction, helping them plan better.

- It builds trust with customers and helps sell more homes.

- Banks feel more confident lending to such projects, as payments are tied to progress.

- Builders stay on schedule, as each stage must be completed to get paid.

A good example is Godrej MSR City in Shettigere. It uses CLP to offer structured payments and keep construction on track. Buyers feel more secure, and the builder benefits from smooth cash flow.

- Builders can't ask for more than 10% upfront before a registered agreement.

- 70% of your money goes into a special bank account for that project only.

- If the builder delays, you can claim a refund or compensation.

- Builders must share updates on construction milestones clearly.

| Plan Type | How It Works | Pros | Cons |

|---|---|---|---|

| Down Payment | Pay 80–90% in a short time | Discounted price | High upfront risk |

| Flexi Plan | Pay in parts—early, mid-way, and end | Balanced | More risk than CLP |

| CLP | Pay as construction progresses | Safer, better control | Slower possession |

| Possession-Linked | Pay 5–20% now, rest at the end | Very low risk | Usually higher price |

- Are the milestones clear? (e.g., "first floor completed")

- Does the builder have a good track record?

- Is the project registered under RERA?

- Is your loan approved in stages, as per CLP?

- Can you keep up with payments if your finances change?

Also, in 2025, interest rates may change. So check the current rates before starting a home loan under CLP.

CLPs offer a safer and more flexible way to buy under-construction homes. They protect your money, give you time to plan your payments, and let you step into the market at the right time. With rules in place and good builders like Godrej MSR City offering such plans, it's no surprise CLPs have become the go-to choice for smart homebuyers in 2025.