Godrej Properties Faces Sentiment Shift as Technical Signals Send Mixed Messages

Godrej Properties' story this quarter is a mix of good demand and softer reported revenue, and that gap is driving the mood. In Q1 FY26, the company posted about 15 percent year on year growth in net profit to roughly ₹600 crore. Bookings were strong at ₹7,082 crore, the eighth straight quarter above ₹5,000 crore. Collections rose 22 percent to ₹3,670 crore. Those are healthy demand signals.

The concern sits on the other side of the ledger. Revenue from operations fell about 41 percent year on year to ₹435 crore, and total income eased around 3 percent to ₹1,593 crore. Operating cash flow also slipped because construction outflows and land payments were higher, which nudged net debt up. In a high rate environment, that makes investors a bit wary. Put simply, sales momentum looks strong, but the pace of revenue recognition and cash generation needs to catch up.

There is a sector layer too. Real estate stocks have been choppy through July and August as talk of sticky rates, cost inflation, and selective block deals kept traders defensive. Godrej's price has moved with that tide, which adds to the cautious tone.

Calling the setup "mixed" is accurate, but it helps to unpack it.

- Moving averages: The stock is trading below key averages like the 50 day and 200 day simple moving averages. That points to a weak near term trend and tells you rallies can meet supply at those lines.

- RSI and momentum: The Relative Strength Index sits in a neutral to slightly oversold zone. That means selling pressure has cooled a bit, but buyers have not taken control yet.

- MACD: On shorter frames, MACD has tilted bearish with a crossover, while longer frames still look only mildly positive. That is exactly what a tug of war looks like on charts.

- Price and volume: Down days with higher than usual volume are a stronger bearish tell than quiet dips. When you see heavier prints, it usually means funds are rebalancing, not just day traders exiting.

Now the stabilizers. Price has shown interest near the recent floor, close to the 52 week low around the ₹1,900 zone. Each time it drifts near there, you see buyers nibble. Analysts' average targets still sit well above spot for many houses, which keeps a longer term anchor under the name. Institutional ownership remains high, so big money is not walking away from the story, even if it trims exposure around events.

Investors are reacting to a basic timing mismatch. Pre sales and collections say customers are buying and paying. Revenue and operating cash flow say recognition is slower because construction milestones and handovers are behind the sales pace. If management converts the current booking run rate into faster recognitions and steadier cash inflows over the next two quarters, the tone can improve quickly.

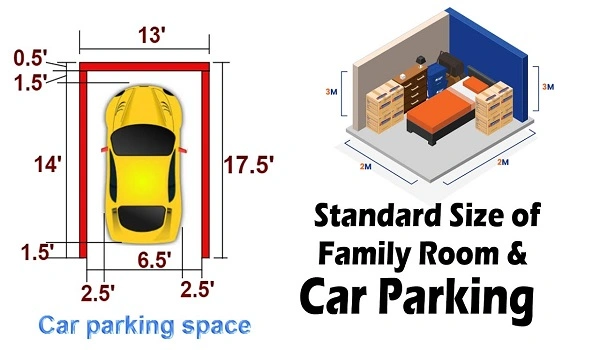

Launch discipline matters here. Godrej has guided for a busy FY26, with a deep pipeline across key cities. Large scale, well located townships tend to support steady absorption. One example is Godrej MSR City at Shettigere in North Bengaluru, a 62 acre high rise township near the airport trumpet road, linked to SH 104 and close to the upcoming metro nodes at Doddajala and Chikkajala. Early phases feature 2 and 3 BHK homes, and the project's size gives the company room to pace launches to demand.

Keep the roadmap simple.

- Immediate support: around ₹2,000, then the stronger band near ₹1,900. A clean close below that second band would warn of a deeper slide.

- First resistance: the 50 day average. A decisive close above it often starts short covering.

- Stronger resistance: the 200 day average. Clearing and holding above it would mark a genuine trend change.

For a quick temperature check, watch how price reacts when it taps the 52 week low area. Higher lows form the base of any repair.

- Next quarterly print: Look for revenue growth to narrow the gap with bookings, and for operating cash flow to improve as construction outflows normalize.

- Launch and absorption data: High velocity in new launches, matched by collections, would ease debt worries and lift confidence.

- Sector tape and rates: A stable to softer rate view, plus a firmer Nifty Realty index, would help the whole basket.

- Any large block trades: Heavy supply from a block can pressure price for a few sessions. If absorption is quick, the hit is usually brief.

Right now, the chart is cautious, not broken. The business engine still shows demand, but the accounts must reflect it faster. If the company converts its order book into revenue and cash at a better clip, the technicals will follow. If that does not happen, the stock can stay range bound and drift at supports while the market waits.

Sentiment around Godrej Properties has cooled because the tape looks weak and revenue recognition lagged a strong bookings quarter. The technicals are mixed for a reason. Bears have the near term trend, bulls still have a long term case built on demand and a full launch calendar. The next two results, the behavior near ₹1,900 to ₹2,000, and proof of steadier cash flow will decide which side wins. In the meantime, watch launches, collections, and those moving averages, since they will likely tell the story before the headlines do.